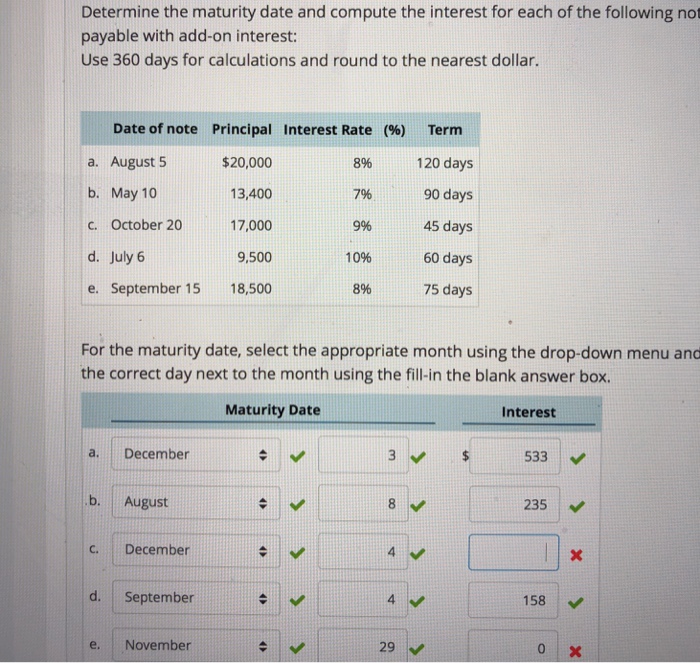

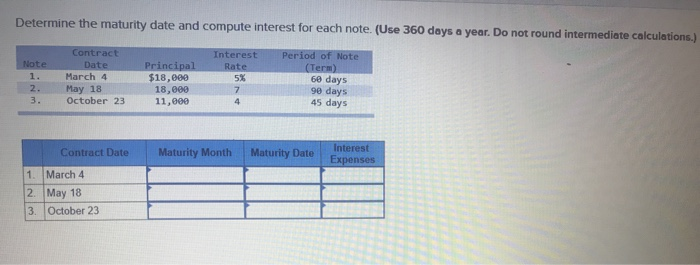

Determine the maturity date and compute interest for each note. Solution Verified Answered 1 year ago Create a free account to view solutions Continue with Google Recommended textbook solutions Financial Accounting 4th Edition • ISBN: 9781259730948 Don Herrmann, J. David Spiceland, Wayne Thomas 1,097 solutions

How Are CD Rates Compounded? | Chase

The following is a basic example of how interest works. Derek would like to borrow $100 (usually called the principal) from the bank for one year. The bank wants 10% interest on it. To calculate interest: $100 × 10% = $10. This interest is added to the principal, and the sum becomes Derek’s required repayment to the bank one year later. $100

Source Image: chegg.com

Download Image

Find the interest and maturity value for a 60-day note with principal of $1,500 and interest at 8 percent. a.$120.00 interest; $1,620.00 maturity value b.$32.88 interest; $1,532.88 maturity value c.$3.29 interest; $1,503.29 maturity value d.$19.74 interest; $1,519.74 maturity value accounting

Source Image: quickenloans.com

Download Image

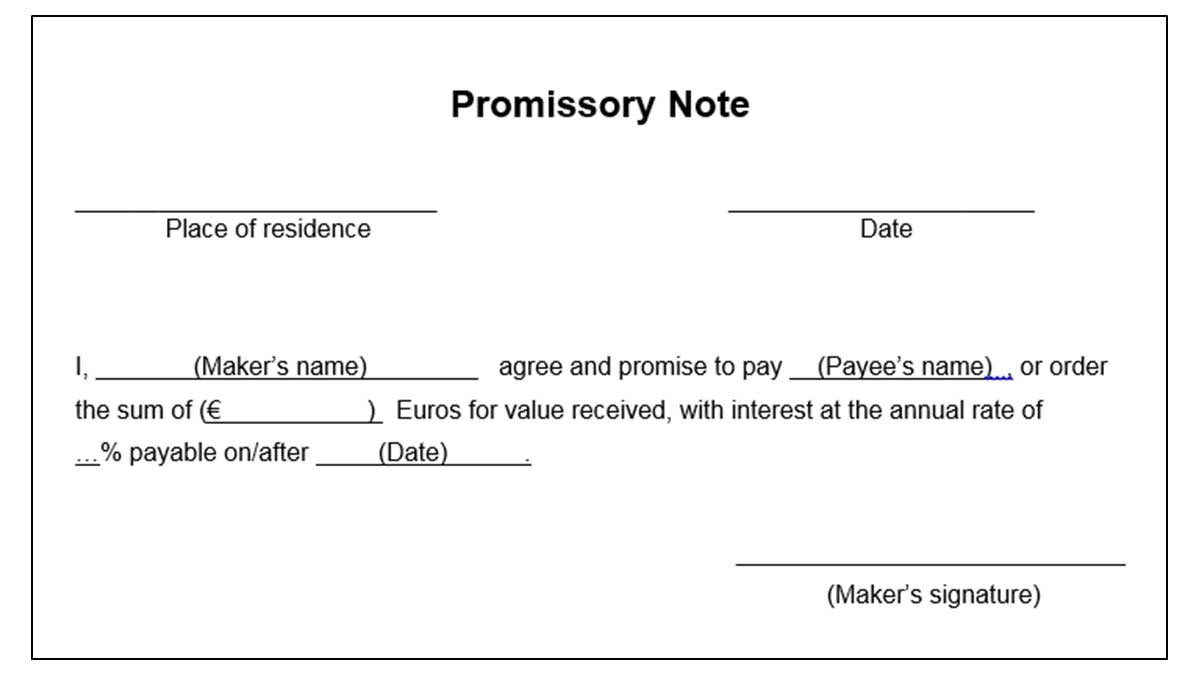

Yield to Maturity – indiafreenotes Explore promissory notes. Learn the definition of a promissory note and understand the different elements that it includes. Review promissory note examples. Related to this Question For each

Source Image: fool.com

Download Image

Determine The Maturity Date And Compute Interest For Each Note.

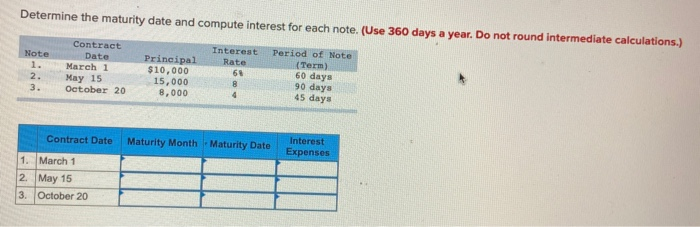

Explore promissory notes. Learn the definition of a promissory note and understand the different elements that it includes. Review promissory note examples. Related to this Question For each Chrisnando Answer: See explanation below Explanation: Required: Determine the maturity date and compute interest 1) Given: Contract date : March 1 Interest :$10,000 Rate: 6% Period of note: 60 days The maturity date for this will be 2 months (60 days) from March 1. Therefore maturity date is May 2. Interest will be calculated as:

Callable or Redeemable Bonds: Types, Example, Pros & Cons | The Motley Fool

May 15, 2022Note that rate r and time t should be in the same time units such as months or years. Time conversions that are based on day count of 365 days/year have 30.4167 days/month and 91.2501 days/quarter. 360 days/year have 30 days/month and 90 days/quarter. … Calculate rate of interest in decimal, solve for r r = (1/t)(A/P – 1) Calculate rate of Principal: Definition in Loans, Bonds, Investments, and Transactions

:max_bytes(150000):strip_icc()/principal.asp-final-80855b2caf65451db5843ac098d0994e.png)

Source Image: investopedia.com

Download Image

SOLVED: Determine the maturity date and compute interest for each note. May 15, 2022Note that rate r and time t should be in the same time units such as months or years. Time conversions that are based on day count of 365 days/year have 30.4167 days/month and 91.2501 days/quarter. 360 days/year have 30 days/month and 90 days/quarter. … Calculate rate of interest in decimal, solve for r r = (1/t)(A/P – 1) Calculate rate of

Source Image: numerade.com

Download Image

How Are CD Rates Compounded? | Chase Determine the maturity date and compute interest for each note. Solution Verified Answered 1 year ago Create a free account to view solutions Continue with Google Recommended textbook solutions Financial Accounting 4th Edition • ISBN: 9781259730948 Don Herrmann, J. David Spiceland, Wayne Thomas 1,097 solutions

Source Image: chase.com

Download Image

Yield to Maturity – indiafreenotes Find the interest and maturity value for a 60-day note with principal of $1,500 and interest at 8 percent. a.$120.00 interest; $1,620.00 maturity value b.$32.88 interest; $1,532.88 maturity value c.$3.29 interest; $1,503.29 maturity value d.$19.74 interest; $1,519.74 maturity value accounting

Source Image: indiafreenotes.com

Download Image

Solved Determine the maturity date and compute interest for | Chegg.com Determine the maturity date and compute interest for each note. (Use 360 days a year. Do not round intermediate calculations.) Note Contract Date Principal Interest Rate Period of Note (Term) 1. March 12 $ 21,000 6 % This problem has been solved! You’ll get a detailed solution from a subject matter expert that helps you learn core concepts.

Source Image: chegg.com

Download Image

Promissory Note – Definition and Parties involved | Paiementor Explore promissory notes. Learn the definition of a promissory note and understand the different elements that it includes. Review promissory note examples. Related to this Question For each

Source Image: paiementor.com

Download Image

Solved Determine the maturity date and compute interest for | Chegg.com Chrisnando Answer: See explanation below Explanation: Required: Determine the maturity date and compute interest 1) Given: Contract date : March 1 Interest :$10,000 Rate: 6% Period of note: 60 days The maturity date for this will be 2 months (60 days) from March 1. Therefore maturity date is May 2. Interest will be calculated as:

Source Image: chegg.com

Download Image

SOLVED: Determine the maturity date and compute interest for each note.

Solved Determine the maturity date and compute interest for | Chegg.com The following is a basic example of how interest works. Derek would like to borrow $100 (usually called the principal) from the bank for one year. The bank wants 10% interest on it. To calculate interest: $100 × 10% = $10. This interest is added to the principal, and the sum becomes Derek’s required repayment to the bank one year later. $100

Yield to Maturity – indiafreenotes Promissory Note – Definition and Parties involved | Paiementor Determine the maturity date and compute interest for each note. (Use 360 days a year. Do not round intermediate calculations.) Note Contract Date Principal Interest Rate Period of Note (Term) 1. March 12 $ 21,000 6 % This problem has been solved! You’ll get a detailed solution from a subject matter expert that helps you learn core concepts.